- Reading time: 3 mins 37 secs

What are Cryptocurrencies?

Cryptocurrencies are dominating the financial world and we are in the midst of the largest transfer of wealth the world has ever seen. But what are cryptocurrencies…

We should start by identifying the difference between ‘digital currency’ and ‘cryptocurrency’. A ‘digital currency’ is an unregulated virtual currency issued and usually controlled by its developers. It is a medium of exchange that operates like a currency in a specific community and not necessarily outside of it.

A ‘cryptocurrency’ is a currency whose principles are based on cryptography. In most cases, cryptocurrency is also a digital currency but not all digital currencies and cryptocurrencies.

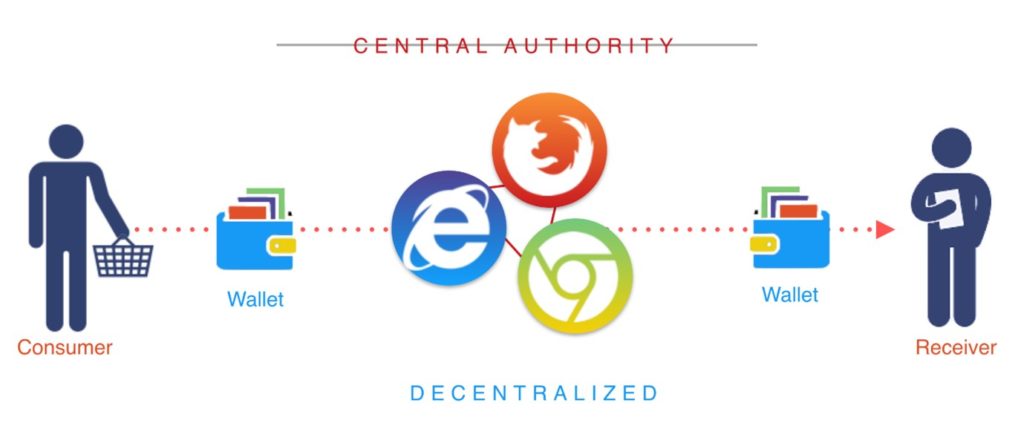

Cryptocurrencies are a type of ‘digital token’ that relies on these principles to chain together digital signatures of token transfers. It is a decentralised system based on a peer-to-peer network. Even in the remotest corner of the world, if you have access to the internet, you can get access to cryptocurrencies and previously inaccessible assets.

multi-millionaire investor

marcus de maria

reveals his secrets.

What are the benefits of Cryptocurrencies?

One of the reasons that cryptocurrencies are becoming so popular is because of the many benefits, such as there is a lower risk involved. To complete a cryptocurrency transaction, you do not need to share your personal information. Instead of ‘pulling’ the information from your credit card transactions, cryptos ‘push’ the amount that is needed to be paid or received to other cryptocurrency holders.

This leads us on to another game-changing benefit of cryptocurrencies, they are not viable to be used for fraud, as your personal information is always hidden, you are protected from identity theft. Due to the decentralised and existing blockchain system, it is unable to be manipulated by an individual or organisation.

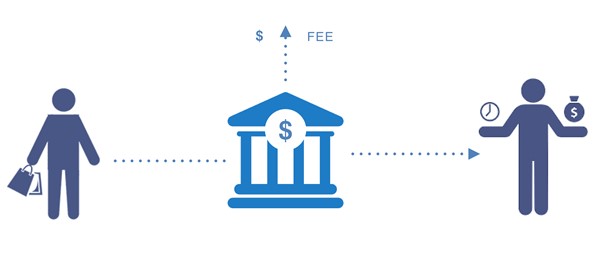

Another attractive quality is: no third-party involvement, meaning there is no intermediary to slow it down or incur any additional charges/fees, giving you complete control over your money. This currency is immune to any influence from your government, with minimum processing fees and no extra charges.

What is blockchain, & how does it work?

One of the most important aspect of cryptocurrencies is the ‘blockchain’. In 2008, Bitcoin was created due to people’s mistrust in the few who had been controlling the entire financial system. The level of trust that people had in their governments, local banks, politicians and the ‘system’ as a whole was at an all-time low and some would say it has not recovered.

The ‘blockchain’ is the public ledger where all cryptocurrency transactions are kept. This system relies on thousands of computers globally connected that are constantly refreshing and updating to display this ledger. This huge network of computers verifies each transaction over and over and saying the same thing, which upholds the ledger’s integrity. Whilst some cryptocurrencies share a blockchain, they can have their own individual one.

With cryptocurrencies, the way they work is like this; imagine if someone sends you £10 and you send that £10 on to someone else. These transactions are stored somewhere, and by someone, to prevent forgeries. The way this normally works is your bank keeps the details of your transaction on a ‘ledger’. This is based on a centralised system. If we use Bitcoin as an example, they turned this whole system on its head. Instead, they have the blockchain controlling this ledger and thousands of computers all around the world. Every single Bitcoin transaction is kept there from the beginning to the present day.

It is also worth explaining the reason that the blockchain requires such a vast quantity of computers to achieve this. The idea originated in aeroplane safety. If you only have one computer in control of the aeroplane’s system and that fails – the plane will crash. If you had three computers, and one crashed but the other two were showing different information to one that failed, it meant that the two outweighed the one and the plane could continue.

Another analogy for this comes from the inventor of Bitgold, Nick Szabo. If a fly is trapped in amber but only has a small layer covering it, you know it has not been there for very long. If it is in a big block of amber, you know it has been trapped for a long time.

When you apply this analogy to the blockchain, it means that every time a transaction occurs, it receives another layer of verification leaving it ‘trapped’ as irrefutable evidence and these transactions can’t be undone.

This is the pivotal factor of cryptocurrencies and the blockchain, as mentioned earlier, there is a lot of distrust with only a few controlling this information. This decentralised system allows it to be in the hands of the many opposed to the few who are trying to control the many.

Cryptocurrencies, like the stock market, have a reputation for being a mystifying industry that you need a financial background to understand. This isn’t true, anyone can learn about cryptocurrencies, and not only that, profit from them.

If you would like to learn more about the world of cryptocurrencies and how you can get involved, download the FREE #1 book ‘Profiting From Cryptocurrencies’.