- Reading time: 6 mins 20 secs

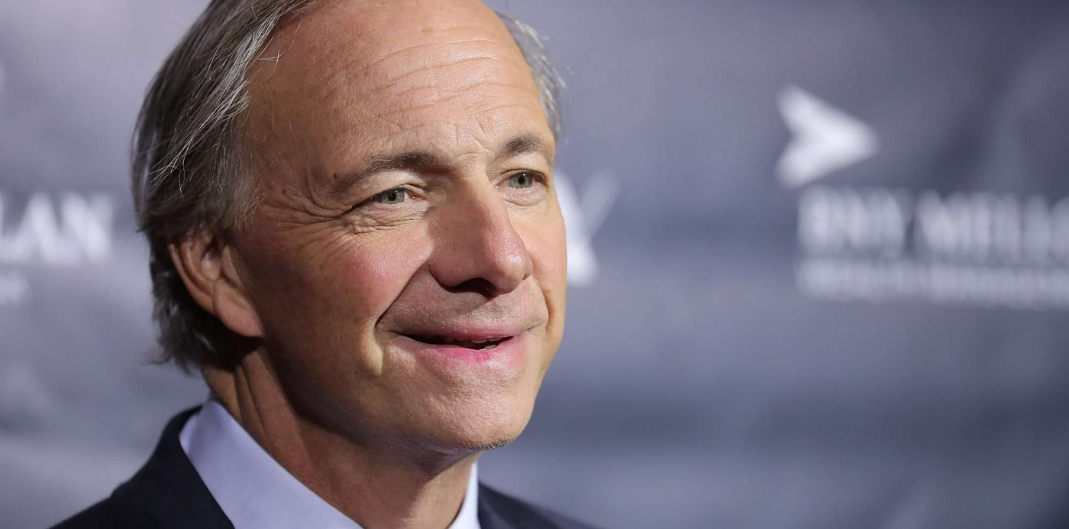

Ray Dalio, the billionaire investor and founder of Bridgewater Associates, is renowned for his unique investment philosophy and principles.

His approach, rooted in systematic thinking and macroeconomic analysis, has been key to his success as a hedge fund manager.

In this article, we explore four core ray dalio principles that every investor should know and provide real-world examples for each one.

But, first of all…

Who is Ray Dalio?

Background

- Ray Dalio was born on August 8, 1949, in Jackson Heights, Queens, New York City, USA. He grew up in a middle-class family and displayed an early interest in financial markets.

- Dalio attended Long Island University and later transferred to Harvard University, where he earned a Bachelor of Arts degree in finance in 1971.

Career Beginnings

- After graduating from Harvard, dalio worked as a clerk on the New York Stock Exchange before joining Dominick & Dominick LLC as a futures trader.

- In 1975, he founded Bridgewater Associates from his two-bedroom apartment in New York City. Initially, Bridgewater operated as a small investment advisory firm.

Bridgewater Associates

- Under Dalio’s leadership, Bridgewater Associates grew to become one of the world’s largest and most successful hedge funds.

- Dalio’s investment philosophy, which emphasises a systematic approach to macroeconomic analysis and risk management, has been instrumental in the firm’s success.

Principles

- One of Ray Dalio’s most significant contributions to the investment world is his publication of ray dalio principles, a set of principles and guidelines for life and work based on his experiences in finance and business.

- He developed these and a principles book over several decades and believes in their universal applicability.

Economic Views

- Dalio is known for his insights into macroeconomic trends and his ability to navigate volatile market conditions.

- He is particularly well-regarded for his understanding of debt cycles and the impact of central bank policies on financial markets.

Philanthropy

- In addition to his work in finance, Ray Dalio is actively involved in philanthropy. Along with his wife, Barbara, he has signed the Giving Pledge, committing to donate the majority of his wealth to charitable causes.

- The Dalio Foundation supports initiatives in education, healthcare, and other areas.

Legacy

- Ray Dalio’s influence extends beyond his success as an investor and entrepreneur. The principles by ray dalio, as well as his insights have inspired countless individuals in the worlds of finance, business, and personal development.

- He continues to be a prominent figure in global finance and a sought-after speaker and author.

- His impact on the world of finance and his commitment to giving back through philanthropy have solidified his legacy as one of the most influential figures in contemporary finance.

The 4 Core Ray Dalio Principles

1. The Economic Machine

Ray Dalio’s investment philosophy is deeply influenced by his understanding of the “Economic Machine.” He believes that understanding how the economy works is fundamental to successful investing.

Dalio breaks down the economic cycle into three main phases:

- Inflationary

- Disinflationary

- Deflationary

Investors should adapt their strategies based on where they believe the economy is in this cycle.

For instance, in the wake of the 2008 financial crisis, Dalio correctly anticipated that central banks would employ aggressive monetary policies to combat deflation.

He adjusted his investment strategy by allocating capital to assets like government bonds, gold, and equities, which performed well during the ensuing recovery and growth phase of the economic cycle.

Dalio’s deep understanding of the global economy allowed him to correctly predict Mexico’s 1980s financial crisis when most others did not, showing he could spot risks and opportunities that many missed.

This expertise to see the big picture played a key role in Dalio building his $17 billion personal fortune.

Principles of Debt

Dalio believes that debt cycles play a crucial role in shaping economic and market conditions. He asserts that periods of excessive debt build-up tend to come first before economic crises. Investors should monitor debt levels in both the public and private sectors to gauge potential risks and opportunities.

Example: Leading up to the 2008 financial crisis, Dalio’s awareness of the housing bubble and excessive leverage in the financial sector prompted him to take bearish positions against certain mortgage-backed securities and financial institutions. These positions paid off handsomely when the crisis hit.

2. Diversification

Ray Dalio realised early on that the economy moves in cycles, swinging between periods of growth and decline.

This shaped his “All Weather” portfolio at Bridgewater, his hedge fund business, which aimed to minimise volatility across market environments.

The key insight was that assets like stocks, bonds and currencies respond differently to conditions. This is called, ‘inverse correlation’ or in plain English, When one zigs, another one zags.

For example, if interest rates go down, the stock market tends to go up.

So by diversifying, Dalio developed his balanced “all weather” portfolio resilient to shifts in the economy – literally weather.

Dalio emphasises the importance of diversification to manage risk in an investment portfolio. He advocates for a well-balanced portfolio that includes a mix of different asset classes, such as stocks, bonds, and commodities, as well as uncorrelated investments such as commodities, real estate, and cryptocurrencies.

Diversification helps spread risk and reduces the impact of individual asset underperformance.

Example: During periods of heightened market volatility, like the COVID-19 pandemic in 2020, a diversified portfolio would have minimised losses. While stocks and many other assets plummeted, the inclusion of safe-haven assets like government bonds and gold would have offset some of the losses, preserving capital.

3. Systematic Decision-Making

Now, when researching potential investments, the ray dalio principles use a very data-driven approach.

Dalio analyses investments using historical pricing, financial figures, and economic indicators to predict market direction.

He also famously advises: “Don’t prematurely bet against hot trends.” This reveals core insights, the first is:

Follow momentum, even when trends don’t seem logical – Markets often continue in the same direction longer than expected.

For example, the 1990s dot-com bubble kept inflating far beyond reason due to speculative mania trumping sound judgement.

Dalio places a strong emphasis on systematic decision-making, which involves creating a set of rules and principles to guide investment decisions rather than relying solely on intuition.

He encourages investors to maintain “principle-based” decision-making processes and to use algorithms and data-driven analysis to identify investment opportunities.

Example: Bridgewater Associates, under Dalio’s leadership, developed a systematic investment approach known as “risk parity.” This approach allocates assets based on their risk contribution rather than their minimal value. It has helped Bridgewater achieve consistent returns by reducing the reliance on subjective judgments and gut feelings.

4. Strategic Selling for Maximum Profit

Ray Dalio’s investment principle of Strategic Selling for Maximum Profit revolves around the idea of making informed decisions about when to sell investments to maximise returns while managing risk.

This principle is grounded in Dalio’s broader investment philosophy, which emphasises the importance of understanding market dynamics, managing risk, and maintaining a disciplined approach to investing.

Similar to buying shares, Dalio lets practical strategies steer his selling decisions too.

So, if an individual stock seems clearly overpriced compared to financial measures, he may trim those heavy positions to lock in existing gains before possible pullbacks.

If some picks become too successful, outgrowing ideal portfolio balances, he rebalances by selling portions of those outperformers and shifting money back towards trailing areas. This maintains balance rather than letting a few selections dominate.

Also, serious weakening in a company’s core business or industry prompts reducing exposure there.

Major economic shifts require adaptations too.

For instance, rising interest rates may necessitate adjusting holdings in rate-sensitive sectors vs those that benefit.

Dalio focuses more on shares of large consumer brands like Procter & Gamble, Coca Cola and Walmart. These tend to sell steady products, commonly known as “consumer durables,” even in recessions.

This makes sense because people will still buy shampoo and shower gel no matter what!

Dalio also bought more overseas emerging market stocks and S&P 500 index funds, which is notable – i.e. the biggest fund manager in the world, investing in a normal S&P 500 basket of shares that ANYONE can invest into.

It’s a solid strategy as what he is doing is spreading money across sectors and also different countries to help soften the blow if US consumers pullback.

So Dalio put more money into defensive, diversified picks able to weather economic storms. This matches his “all weather” philosophy of being ready for different market conditions.

Real-Time Ray Dalio Investment Examples:

Starbucks – Dalio sees immense future growth as rising Asian incomes make branded coffee more accessible. This captures powerful demographic shifts.

Visa – Dalio recognises the enduring trend towards cashless payments as commerce moves increasingly online. This identifies durable secular changes.

Costco – because of its’ loyal customer base, Dalio finds revenues resilient even in varied economies. This represents stability despite shifting conditions.

General US market exposure – an index like the S&P 500 ETF or Exchange Traded Fund provides broad diversification. This balances his stock picks as he blends in index funds to balance risky bets.

Cryptocurrencies

Dalio also invested in the emerging digital currency Bitcoin in 2021, (though the exact sum remains undisclosed).

Dalio recommends a 1-2% Bitcoin allocation, citing its long-term potential while accepting the volatility. As someone who made almost $10 million from crypto, it’s not surprising to see Dalio strategically embrace this next-generation asset.

Example: Imagine you’re an investor who holds a diversified portfolio of stocks and bonds. Over the past few years, the stock market has experienced a prolonged bull run, and many of your stock investments have performed exceptionally well, appreciating significantly in value. However, based on your analysis of economic indicators and market trends, you begin to sense that the stock market may be becoming overvalued, and there are signs of potential economic trouble ahead. By applying Ray Dalio’s principle of strategic selling for maximum profit, you aim to navigate market cycles effectively, capture gains during periods of market strength, and protect your portfolio from potential downturns or volatility, ultimately maximizing long-term investment returns.

Learn from the Masters!

Dalio’s investment principles are not static but evolve in response to changing market conditions and new insights. Investors should continuously learn from their experiences, refine their strategies, and adapt to evolving market dynamics to remain successful over the long term.

Ray Dalio’s investment principles offer valuable insights for investors seeking to navigate the complexities of financial markets.

Understanding the economic cycle, embracing diversification, monitoring debt levels, and adopting systematic decision-making processes are key elements of Dalio’s philosophy.

By applying these principles and learning from Dalio’s successes and challenges, investors can enhance their own strategies and better position themselves for long-term investing success.

So, how can you apply the proven investment principles ray dalio uses in your own portfolio?

- First, study economic cycles. Dalio realised economies swing between growth and decline. Understanding these patterns can reveal the next market direction.

- Next, diversify across sectors. Blend assets like stocks and bonds that react differently to conditions. This balance minimises volatility.

- Also, stress test investments. Map out scenarios to see risks beforehand. This aligns with Dalio’s data-driven analysis as opposed to gut feel.

- The key is balancing risk smartly across your portfolio rather than chasing maximum returns. This fits Dalio’s central philosophy of having an ‘all weather’ portfolio.

For more on Ray Dalio investment principles consider this YouTube Channel Subscription